Cyber Security Investment Fund

It s fair to say that it s a hot investment right now.

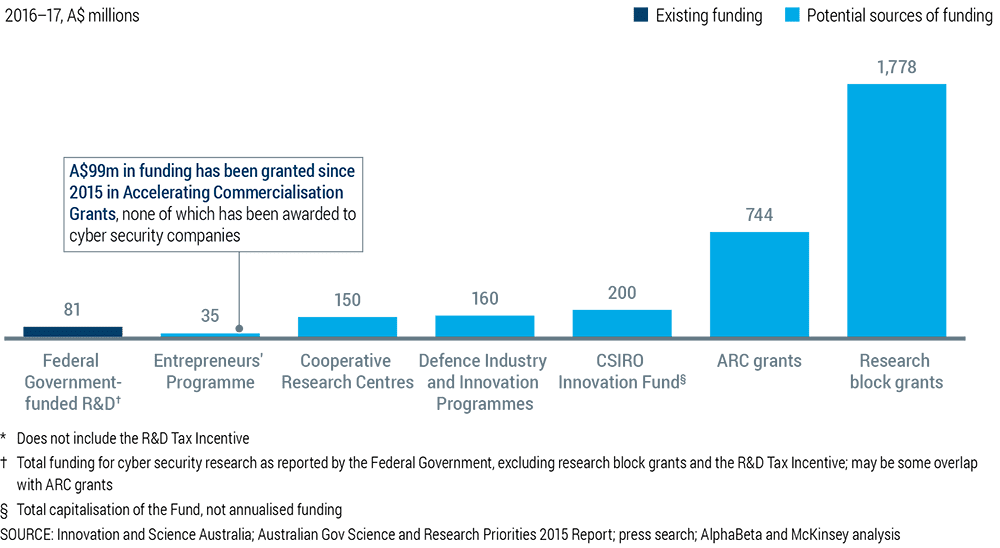

Cyber security investment fund. The fund tracks the nasdaq cta cyber security index. In the world of cybersecurity funds exchange traded funds etfs are often tapped by investors. An increase in threats and cyber attacks against enterprise systems data and personnel requires an investment in innovative organizations to provide defensive solutions. Apples to apples to oranges.

The bottom line. Forgepoint capital has announced the 450 million fund ii the industry s largest fund focused exclusively on cyber security. While cybersecurity etfs can have long term growth potential the short term market risk for funds investing in just one small sector of the market should be noted. This unknown cyber security fund has gained 33pc in two years save high profile cyber attacks are increasing in frequency credit.

Etfs that are highly concentrated in a narrow niche industry should represent a small portion such as 5 to 10 of a diversified portfolio before investing in sector funds like these investors should first. Etfmg prime cyber security etf weights its various stocks more equally regardless of how large the company is and includes smaller start ups valued all the way down to 100 million. The cyber skills immediate impact fund aims to increase the diversity and numbers of those working in the uk s booming cyber security sector. Its holdings must be classified as a cybersecurity company by the consumer technology association and have a minimum market cap of 250 million.

0 60 per year or 60 on a 10 000 investment. 0 60 or 60 annually per 10 000 invested. Etfmg prime cyber security etf has an msci esg fund rating of bbb based on a score of 4 90 out of 10. Purefunds hack and first trust s cibr cybersecurity etfs are relative newcomers in the investment world both having launched within the last.

:max_bytes(150000):strip_icc()/stock_chart_shutterstock_488648419-5bfc3affc9e77c00587b1e40.jpg)