Dc Open Doors Income Limits

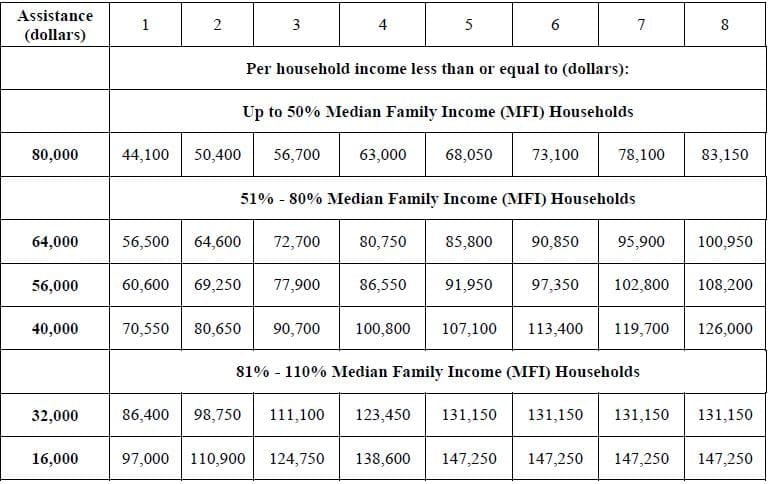

Affordable housing program income limits.

Dc open doors income limits. Borrower does not need to be a first time homebuyer cannot own any other property at time of settlement borrower income may not exceed 151 200 not based upon household income minimum credit score of 640. Dc open doors interest rates fha 2 625 fha plus w dpa 2 875 hfa conventional no dpa 80 ami 2 750 hfa conventional w dpa 80 ami 2 875. New income cap for 2020. The improvements they are introducing deliver to ensure safe and affordable housing for more washingtonians.

3 or more person household. Watch the video for more information. A mortgage credit certificate mcc may be purchased in conjunction with any of our dc open doors loan programs or it may be purchased as a stand alone product in conjunction with other first trust mortgage loans. The dc open doors loan provides zero down payment financing to purchasers in washington dc.

Dc open doors makes homeownership in washington dc affordable by offering qualified buyers home purchase loans and down payment assistance. In order to qualify for dc open doors you must meet the minimum requirements below. 151 200 based on applicant qualifying income not household income. Department of housing and urban development hud.

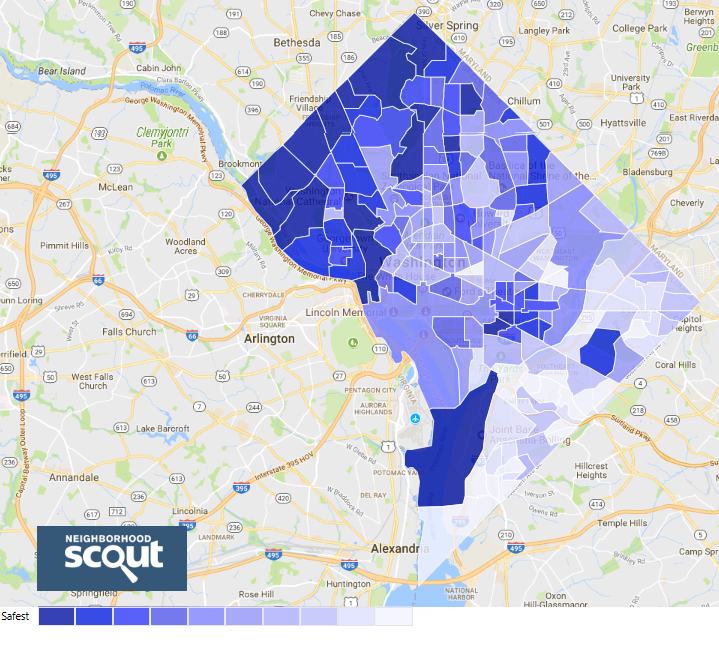

Required depending on loan product used click to. First trust lender must be a dchfa participating lender. See dc open doors lender manual. Income limits range from 80 to 110 percent of area median income currently 121 300 for a four person household.

Each year the dc department of housing and community development dhcd issues rent and income limits for several programs based upon median family income mfi also known as area median income ami information from the u s. The maximum borrower income for all dc open doors loan programs is now 132 360 widening the range buyers that may qualify for the dc open doors loan program. Home acquisition limits non target max 625 764. To help individuals in washington dc achieve their dreams of homeownership the district of columbia housing finance agency dchfa started dc open doors the program offers home loans as well as down payment assistance to qualifying applicants in order to help them out of the renter s trap.

The program offers deferred repayable loans for a homebuyer s minimum down payment requirement in addition to below market interest rates for first trust mortgages for the purchase of homes in the district of columbia.